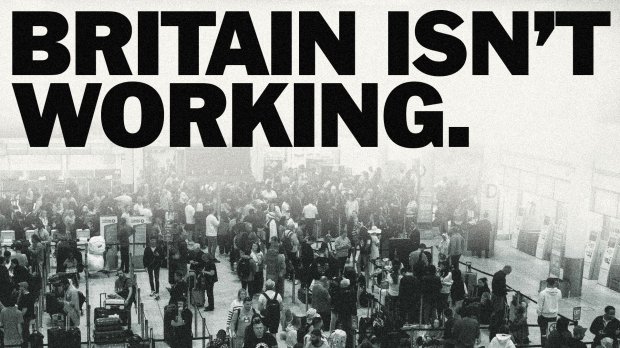

Campaigning in Putney in 1978, Mrs Thatcher famously took out a pair of scissors and cut a pound note down the middle, telling her audience that the remaining stump represented what was left of the pound in your pocket after four years of Labour and high inflation.

David Cameron may soon be able to repeat the stunt — except rather than cutting a note in half he will be able to stick a bit on the end to represent the extra buying power being granted to consumers courtesy of deflation.

Already a subscriber? Log in

Get 10 issues

for $10

Subscribe to The Spectator Australia today for the next 10 magazine issues, plus full online access, for just $10.

- Delivery of the weekly magazine

- Unlimited access to spectator.com.au and app

- Spectator podcasts and newsletters

- Full access to spectator.co.uk

Unlock this article

You might disagree with half of it, but you’ll enjoy reading all of it. Try your first month for free, then just $2 a week for the remainder of your first year.

Comments

Don't miss out

Join the conversation with other Spectator Australia readers. Subscribe to leave a comment.

SUBSCRIBEAlready a subscriber? Log in