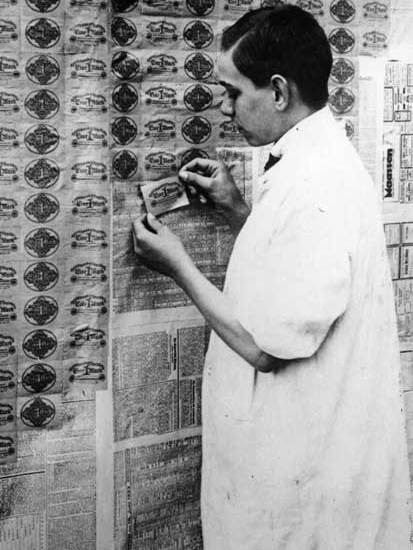

In Germany in 1923 money was losing its value so fast that the state printing works could not keep up. The work had to be contracted out to 130 different printing firms, all churning out marks with the lifespan of mayflies.

Only ten years earlier, the mark had been as good as gold. Then Germany had set out to fight a short war and send the bill to the losers. This had worked well the last time round: after the 1870 war, France had handed over 5 million gold francs, not to mention two provinces. But the 1914 war turned out to be longer and far more expensive, and Germany had to pay its own way — which meant borrowing — and the Reichsbank, as a wartime precaution, had taken the mark off the gold standard. In the end there were losers all round.

Frederick Taylor tells the story.

The years of war saw the mark lose three-quarters of its purchasing power. The years of peace saw the process speed up, as the borrowing continued, and at first it had its friends. ‘I am not afraid of inflation,’ said Walther Rathenau, tycoon and minister, later murdered by two proto-Nazis. ‘People are wrong when they say that printing money is bringing us to ruin. We ought to print money a bit faster, and start construction works.’ He has his followers today.

Soon enough, money was being printed so fast that prices were rising by 50 per cent month on month. Beyond that point it fails in its function as a store of value or a medium of exchange, and becomes the losing card in a game of Slippery Ann. The player who is dealt this card needs to hand it on as fast as possible and exchange it for something else — anything else.

The results were grotesque. Bank balances melted away, and so did mortgages. A judge was paid his monthly salary and hurried out to spend it, coming back, to his family’s fury, with a collar-stud — all he could find. The only price to come down, says Taylor, was that of virginity. Nice girls would save up to be married, putting money aside for a dowry. Then inflation wolfed their savings and they saw no more reason to wait.

Inflation wolfed everyone’s savings. The well-meaning citizens who had bought war bonds found that these were now effectively worthless. The dividend warrants might still be made out but would not be sufficient to pay for the postage. What was needed was a currency with something behind it, just as in the happy days before 1914, when the mark — and the pound, for that matter — were backed by gold.

With the wave of a wand, it arrived — a new kind of mark, supposedly backed, not by gold, but at least by assets such as farmland. This was, of course, a confidence trick, but confidence was what it needed. Soon enough a trillion of the old marks could be swapped for one of the new marks, which took over. Hjalmar Schacht, the wizard who brought the trick off, took care not to print too many of the new ones.

Got something to add? Join the discussion and comment below.

Get 10 issues for just $10

Subscribe to The Spectator Australia today for the next 10 magazine issues, plus full online access, for just $10.

You might disagree with half of it, but you’ll enjoy reading all of it. Try your first month for free, then just $2 a week for the remainder of your first year.

Comments

Don't miss out

Join the conversation with other Spectator Australia readers. Subscribe to leave a comment.

SUBSCRIBEAlready a subscriber? Log in